Red or Blue = Green. On the fence to buy due to the election and interest rates? Now is a sweet spot for Buyers and Real Estate Investors.

1. Elections: Home Prices Tend to Rise After, Regardless of Outcome

Election years often bring uncertainty, but historically, home prices have consistently gone up after elections, regardless of which party wins. Let’s take a look at the past few cycles:

– 2000: George W. Bush (R) was elected, and home prices rose steadily in the following years.

– 2008: Barack Obama (D) was elected during the financial crisis, yet home prices began to recover afterward.

– 2016: Donald Trump (R) was elected, and home prices continued their upward trajectory.

– 2020: Joe Biden (D) was elected during a global pandemic, and home prices surged after the election.

The takeaway? While elections may cause short-term uncertainty, historically, home prices rise once the results are in, no matter who wins. Waiting for the election to pass might mean paying more for a home later.

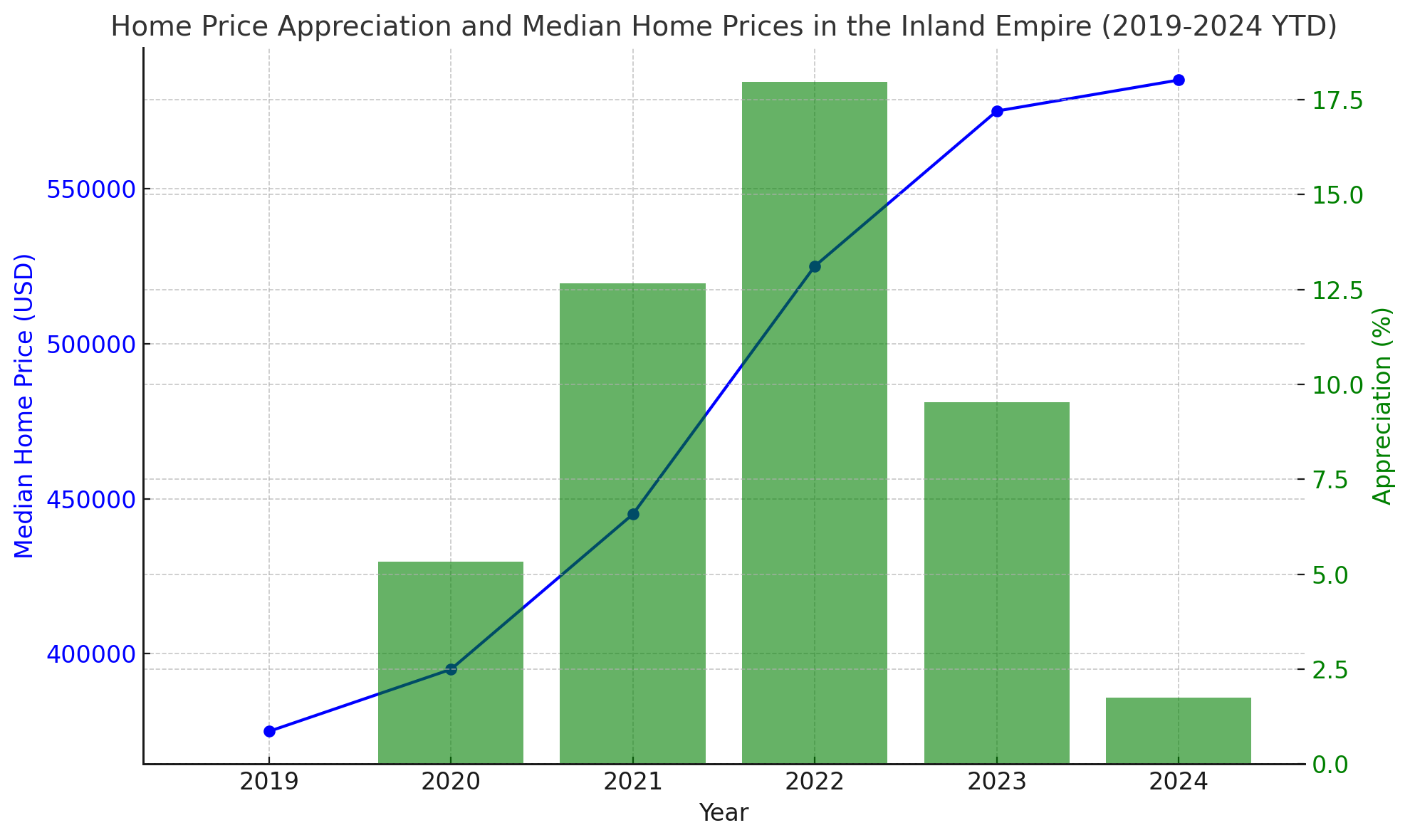

2. Interest Rates: Fluctuations Haven’t Stopped Home Prices from Rising

Interest rates have been on a bit of a rollercoaster recently, but one thing has remained constant: home prices in the Inland Empire have kept going up. Here’s how it breaks down:

– 2019: Rates were around 4%, and median home prices were $375,000.

– 2020: Rates dropped below 3%, which led to a 5% jump in prices, bringing the median to $395,000.

– 2021: With rates at 3.5%, prices surged by 12.66% to $445,000.

– 2022: Rates rose to 6.5%, but prices still increased by nearly 18%, reaching $525,000.

– 2023: Despite rates in the 6.5%-7% range, prices grew by 9.5%, reaching $575,000.

– 2024 (YTD): Rates are holding at 6.5%, and prices have continued to rise modestly by 1.74%, bringing the median to $585,000.

Even with higher rates, prices have been on the rise. The pace may have slowed, but it’s clear that the housing market is still appreciating. Acting now could put you ahead of the curve before prices climb higher.

3. Inventory Levels: Back to Pre-Pandemic, Signaling a More Normal Market

Let’s talk about inventory. During the pandemic, homes were flying off the market faster than concert tickets. But today, things are looking much more balanced, with inventory levels returning to what we’d consider pre-pandemic norms. This means buyers are seeing more options and less competition.

– Pandemic Boom: In 2020-2021, buyers had to deal with extremely low inventory, bidding wars, and homes selling above asking price—often within days of being listed.

– 2023-2024: The market has cooled to a more “normal” level. Inventory has bounced back to where it was before the pandemic frenzy, signaling a healthier and more balanced market. Homes are staying on the market longer, and buyers have more time to explore their options without the pressure of multiple competing offers.

With more inventory available and sellers becoming more flexible, buyers have the upper hand in negotiations. This is your chance to secure a better deal before the market potentially heats up again.

4. The Cost of Waiting: Price Increases, Interest Rates, and Inflation

Many buyers hold off on purchasing, hoping for lower interest rates. While rates may eventually come down, waiting might not be the best strategy when considering price trends and the impact of inflation. Forecasts suggest that interest rates could drop to the low 5% range by the end of 2025, and we’re already seeing a slight downward trend. But here’s why waiting could still cost you:

– Price Increases: Even with a potential drop in interest rates, home prices are likely to keep rising. As the market heats up again with more buyers entering when rates fall, demand will increase, and so will prices. Waiting for lower rates could mean paying a higher price for the same home.

– Inflation’s Role in Appreciation: Inflation also plays a role in rising home prices. As inflation increases the cost of goods and services, it can push up the cost of new construction, materials, and overall housing supply, driving home prices higher. Historically, real estate has been a solid hedge against inflation, as home values tend to appreciate faster in inflationary environments. By waiting, you could face not only higher prices but also the compounding effects of inflation on those prices.

– Long-Term Investment: Buying now allows you to start building equity at today’s prices. As interest rates trend downward, you can always refinance to secure a lower rate. Meanwhile, your home will likely appreciate in value, especially if inflation continues to impact the market.

The key takeaway: If you wait for rates to drop, you could end up paying more due to rising home prices and inflation’s impact on housing costs. Acting now locks in current prices, and if rates do drop, you can refinance for an even better deal down the road.

Key Takeaways: Timing the Market Can Be Tricky

While it’s tempting to wait for ideal conditions, history shows that home prices tend to keep rising, regardless of interest rate fluctuations. The current market offers some unique advantages for buyers, especially with inventory back to more balanced levels. Here’s what to consider:

– Home prices are steadily increasing, even with higher interest rates.

– Inventory has returned to pre-pandemic levels, giving buyers more options and negotiating power.

– Interest rates may drop, but when they do, prices could rise with increased demand.

– Inflation is contributing to rising home values, making real estate a strong long-term investment.

Final Summary: Consider the Bigger Picture

While waiting for lower interest rates might seem tempting, it’s worth considering how much home prices could increase by then. Buying now gives you the opportunity to lock in current prices, and if rates drop later, you can always refinance. It’s all about looking at the long-term benefits of homeownership and making a move when it feels right for you.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link